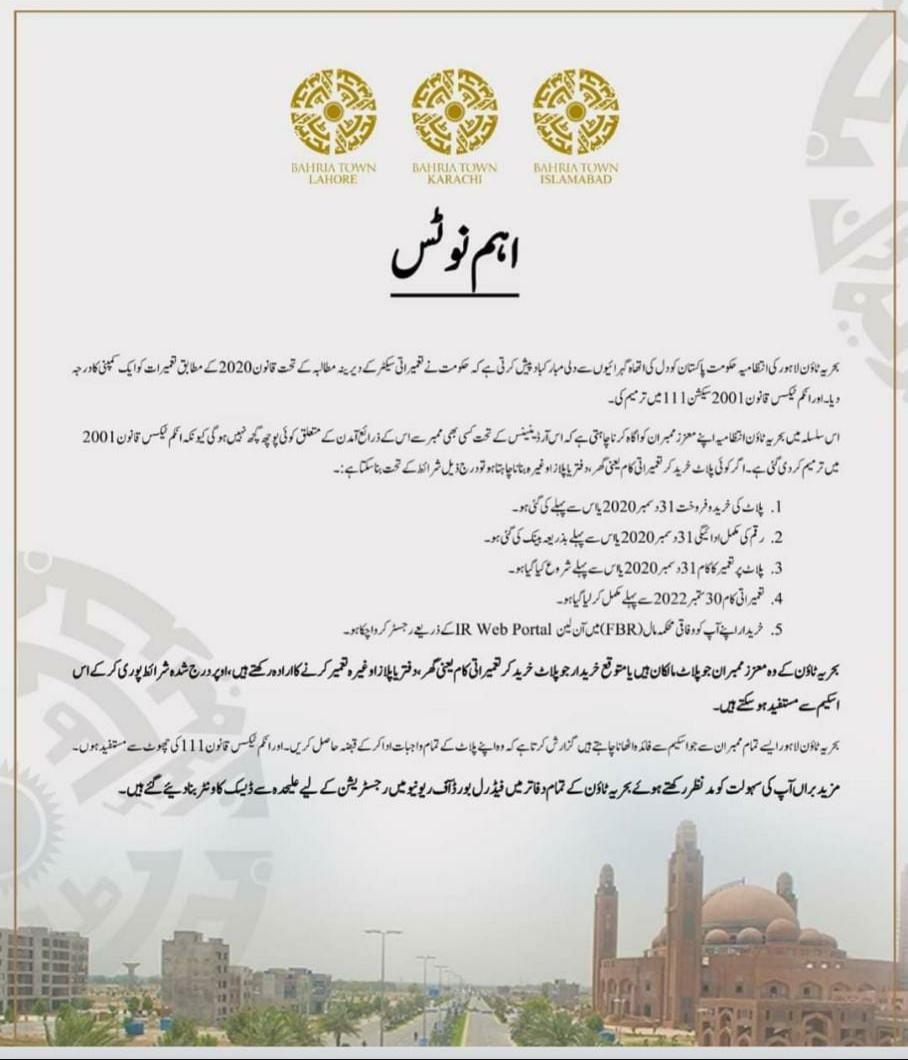

Important Notice as per Income Tax Ordinance 2001 (Section 111)

Bahria Town Lahore Management has expressed its heartiest congratulations to the Government of Pakistan for amendment in Income Tax Ordinance 2001, Section 111. According to the Law of 2020, the government has fulfilled our prolonged demand by giving recognition to the construction sector as an industry. This is an Important Notice as per Income Tax Ordinance 2001 (Section 111).

In this respect, Bahria Town Administration wants to inform its respectable members that according to the ordinance, proof of source of income will not be required from any of the members, because income tax ordinance 2001 has been amended.

Interested clients may buy the plot for residential or commercial construction

under following terms and conditions.

1. Sale and purchase of plot should be on or before 31 December 2020.

2. Complete payment should be made through the bank till 31 December 2020.

3. Construction on plot should have been started on or before 31 December 2020.

4. Construction work should have been completed till 30 September 2022.

5. The buyer should have registered himself

online on FBR web portal.

Respected members of Bahria Town, who are either plot owners or expected buyers

for plots to be constructed for residential or commercial use, may avail the

scheme by fulfilling above mentioned terms and conditions.

Bahria Town Lahore, has requested all those members who want to avail the

opportunity, to get the possession of their plots after paying all the dues.

Moreover, they have set up separate desk counters for registration in FBR in

all the offices of Bahria Town, to facilitate their respected members. This can

prove to be useful for all existing and potential clients.

This among other improvements will result in a massive enhancement of the future of real estate markets.

If you are looking for further assistance and guidance on the subject then you may contact one of our expert advisors at the given contact details in the following link. ||CLICK HERE||